GREENEVILLE, Tenn.—(BUSINESS WIRE)—Forward Air Corporation (NASDAQ:FWRD) (the “Company”, “we”, “our”, or “us”) today reported financial results for the three and twelve months ended December 31, 2021 as presented in the tables below on a continuing operations basis (Pool Distribution was previously reported as a discontinued operation).

This press release features multimedia. View the full release here.

Forward Air Corporation Reports Fourth Quarter 2021 Results (Photo: Business Wire)

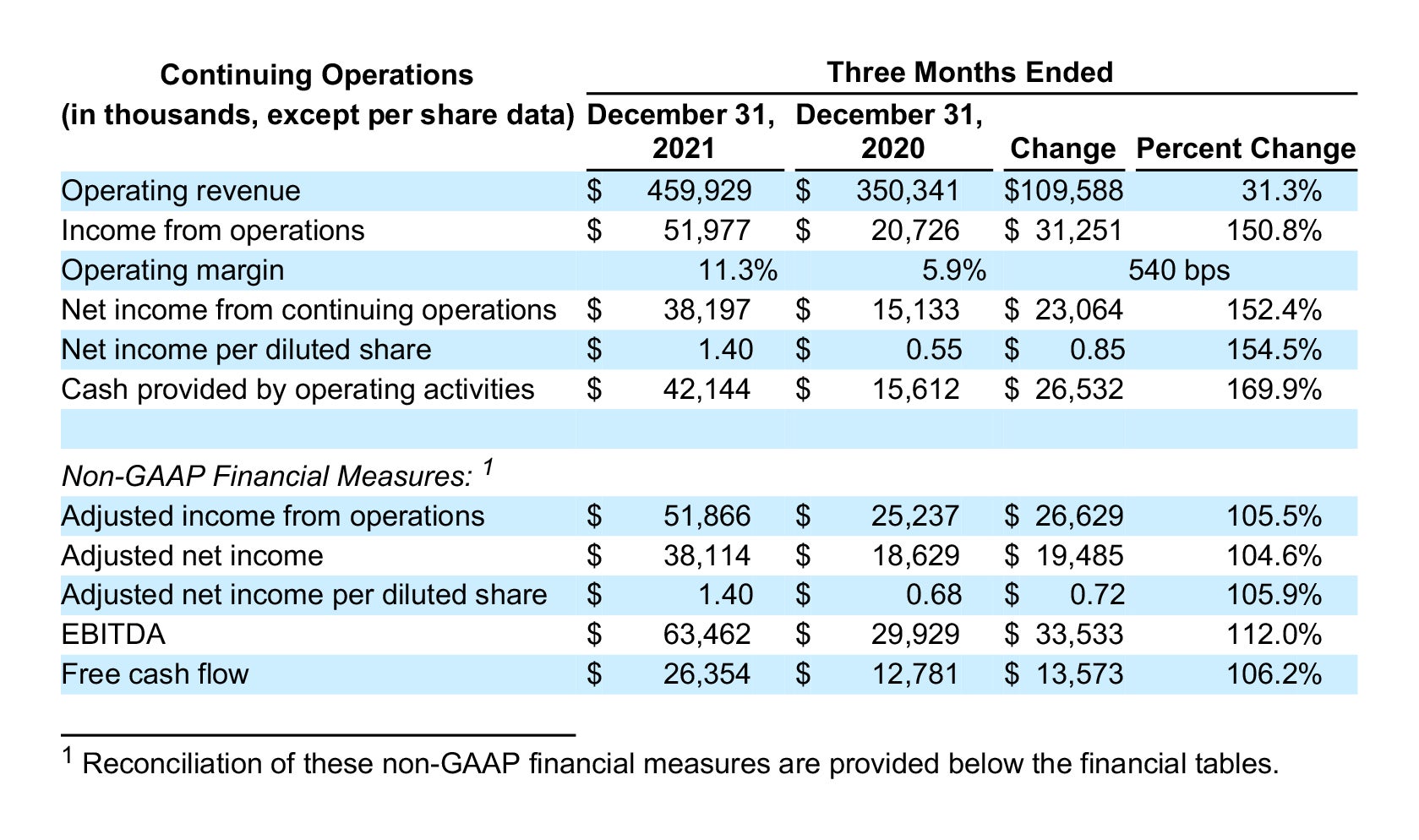

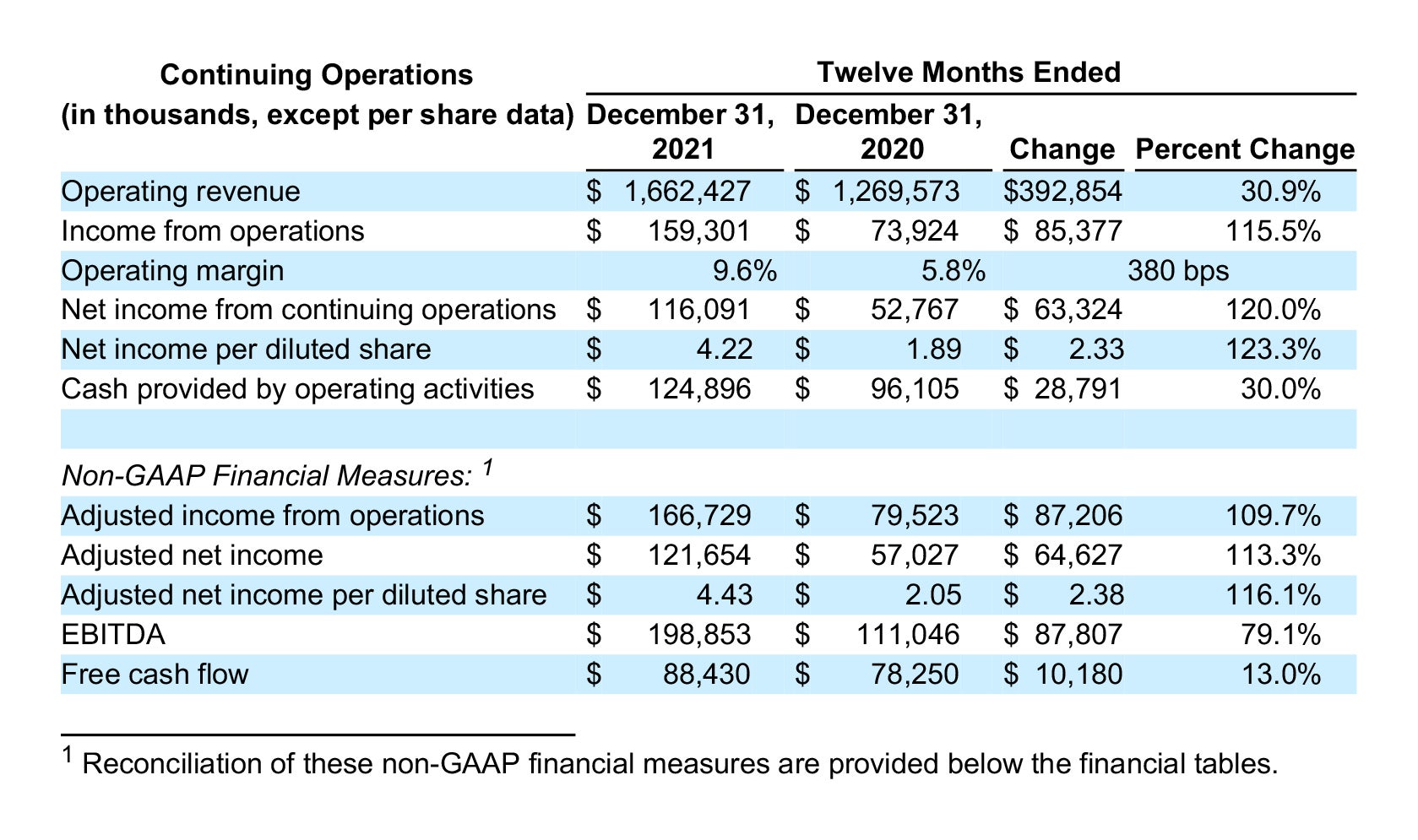

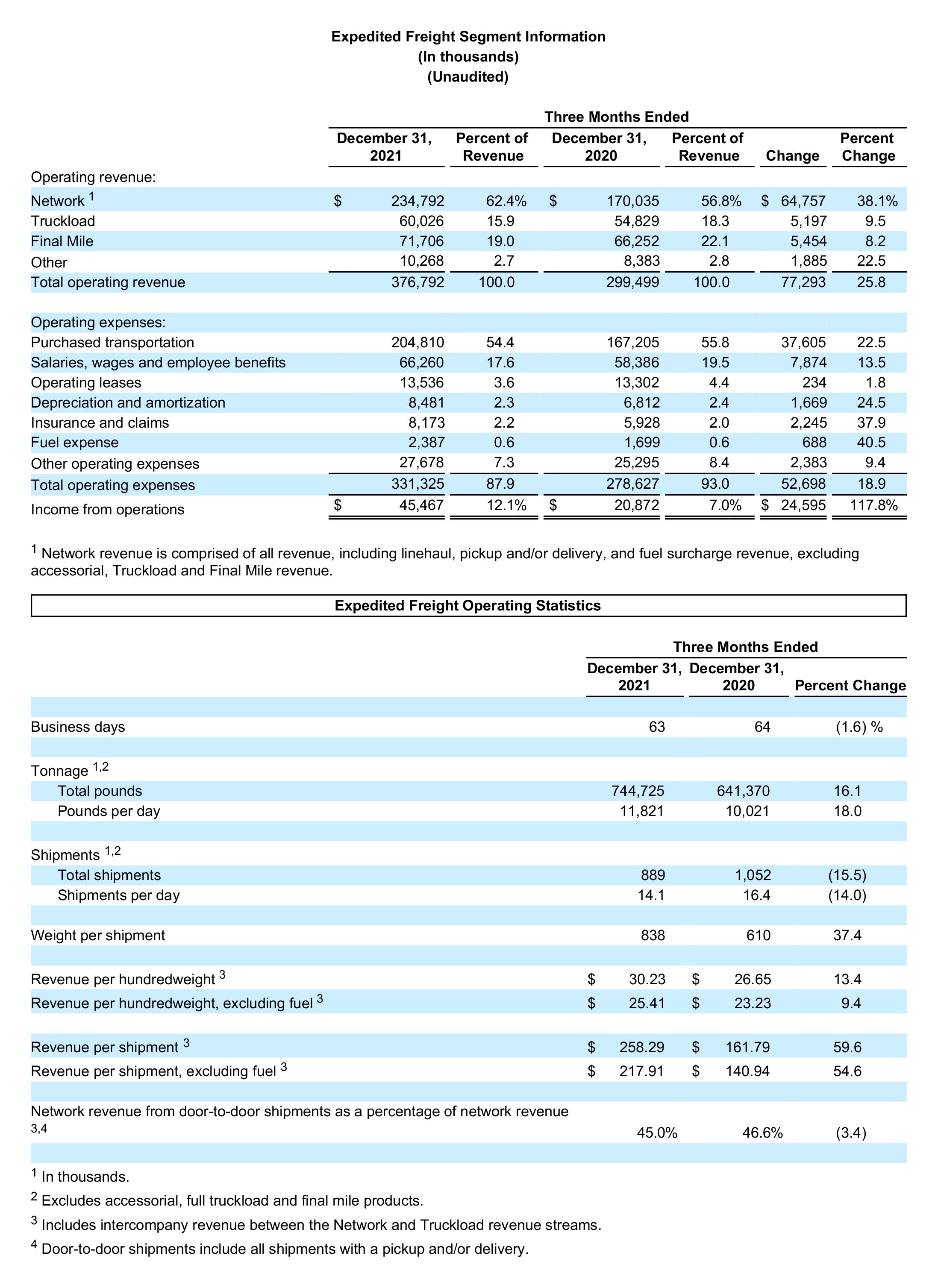

Tom Schmitt, Chairman, President and CEO, commenting on fourth quarter results from continuing operations, said, “Our fourth quarter reported revenue, net income and net income per diluted share represent the best quarterly financial performance in Forward history and each set all-time quarterly records. With higher quality freight in our network, our less-than-truckload line of business reported record levels in weight per shipment and revenue per shipment for the fourth quarter. Our solid growth strategies combined with continued strong demand for our services drove our record fourth quarter revenue growth of 31%, which came in above the high end of our guidance range of 23% to 27%. Our record reported net income per diluted share of $1.40 exceeded the high end of our $1.25 to $1.29 guidance range.”

Mr. Schmitt continued, “We anticipate solid performance in the first quarter of 2022 with volumes expected to exceed the same period of 2021. For the month of January, our revenue per shipment increased 54.8%, weight per shipment increased 33.0% and tonnage increased 10.7% year-over-year. Based on the continued precision execution of our strategic priorities, at this moment, we are ahead of pace toward our previously announced full year 2023 targets.”

In closing, Mr. Schmitt said, “We achieved record-breaking annual performance in 2021. I would like to thank our employees and independent contractors for their remarkable efforts to serve our customers and their valuable contribution to this important milestone for Forward.”

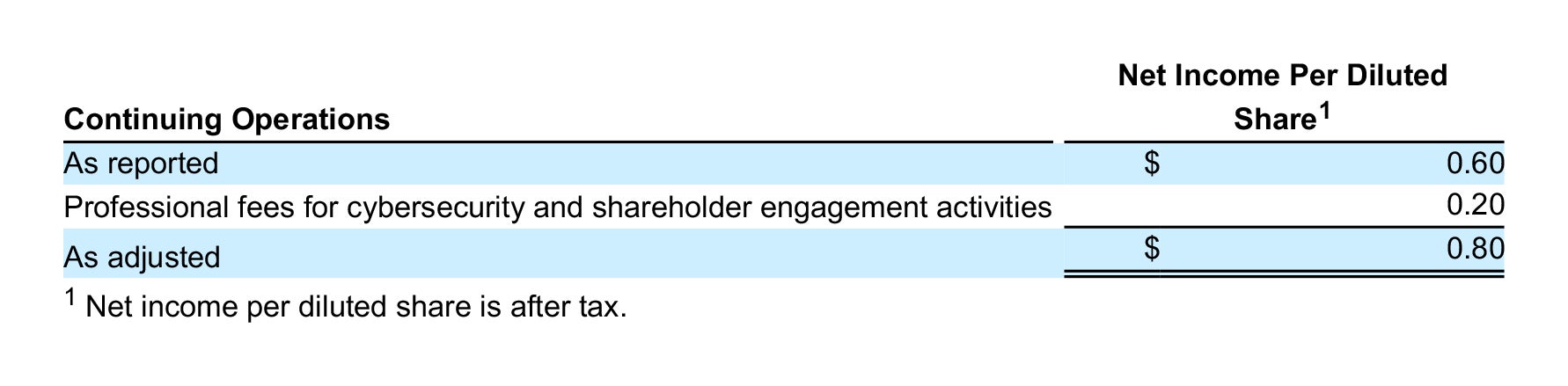

Regarding the Company’s first quarter 2022 continuing operations guidance, Rebecca J. Garbrick, CFO, said, “We expect first quarter year-over-year revenue growth of 18% to 22% and net income per diluted share to be between $1.15 to $1.19, compared to reported net income per diluted share of $0.60 and adjusted net income per diluted share of $0.80 in the first quarter of 2021.”

On February 8, 2022, our Board of Directors approved a 14% increase to the Company’s quarterly dividend, raising it from $0.21 to $0.24 per share of common stock. The dividend is payable to shareholders of record at the close of business on March 3, 2022 and is expected to be paid on March 18, 2022.

This quarterly dividend is made pursuant to a cash dividend policy approved by the Board of Directors, which anticipates a total annual dividend of $0.96 for the full year 2022, payable in quarterly increments of $0.24 per share of common stock. The actual declaration of future cash dividends, and the establishment of record and payment dates, is subject to final determination by the Board of Directors each quarter after its review of the Company’s financial performance.

Commenting on the increased dividend payment, Ms. Garbrick said, “This increase reflects our confidence in the growth potential of our businesses, and the Company’s continued focus on returning a portion of its free cash flow back to shareholders. In the past five years, we have returned approximately $365 million to shareholders in the form of dividends and share repurchases.”

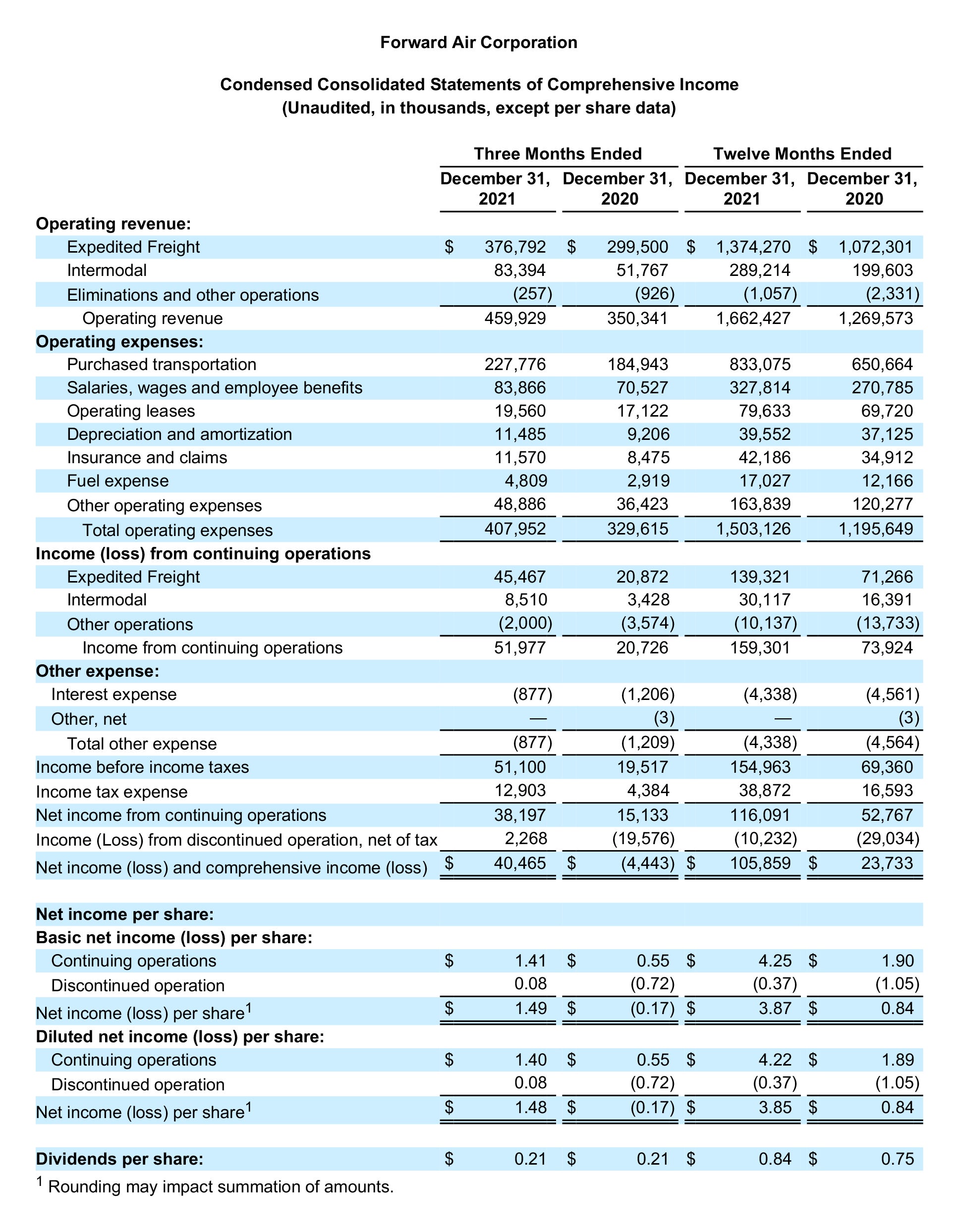

The Board approved a strategy to divest the Pool Distribution business (“Pool”) on April 23, 2020, and the sale of Pool was completed on February 12, 2021. Accordingly, the results of operations and cash flows for Pool have been presented as a discontinued operation and have been excluded from continuing operations in this release for all periods presented. In addition, Pool assets and liabilities were reflected as “held for sale” on the Condensed Consolidated Balance Sheets in this press release for the prior period.

Review of Financial Results

Forward Air will hold a conference call to discuss fourth quarter 2021 results on Thursday, February 10, 2022 at 9:00 a.m. EST. The Company’s conference call will be available online on the Investor Relations portion of the Company’s website at www.forwardaircorp.com, or by dialing (844) 867-6169, Access Code: 3231672.

A replay of the conference call will be available on the Investor Relations portion of the Company’s website at www.forwardaircorp.com, which we use as a primary mechanism to communicate with our investors. Investors are urged to monitor the Investors Relations portion of the Company’s website to easily find or navigate to current and pertinent information about us.

About Forward Air Corporation

Forward Air is a leading asset-light freight and logistics company that provides services across the United States and Canada. We provide expedited less-than-truckload (“LTL”) services, including local pick-up and delivery, shipment consolidation/deconsolidation, warehousing, and customs brokerage by utilizing a comprehensive national network of terminals. In addition, we offer final mile services, including delivery of heavy-bulky freight, truckload brokerage services, including dedicated fleet services; and intermodal, first-and last-mile, high-value drayage services, both to and from seaports and railheads, dedicated contract and Container Freight Station warehouse and handling services. We are more than a transportation company. As a single resource for your shipping needs, Forward is your supply chain partner. For more information, visit our website at www.forwardaircorp.com.

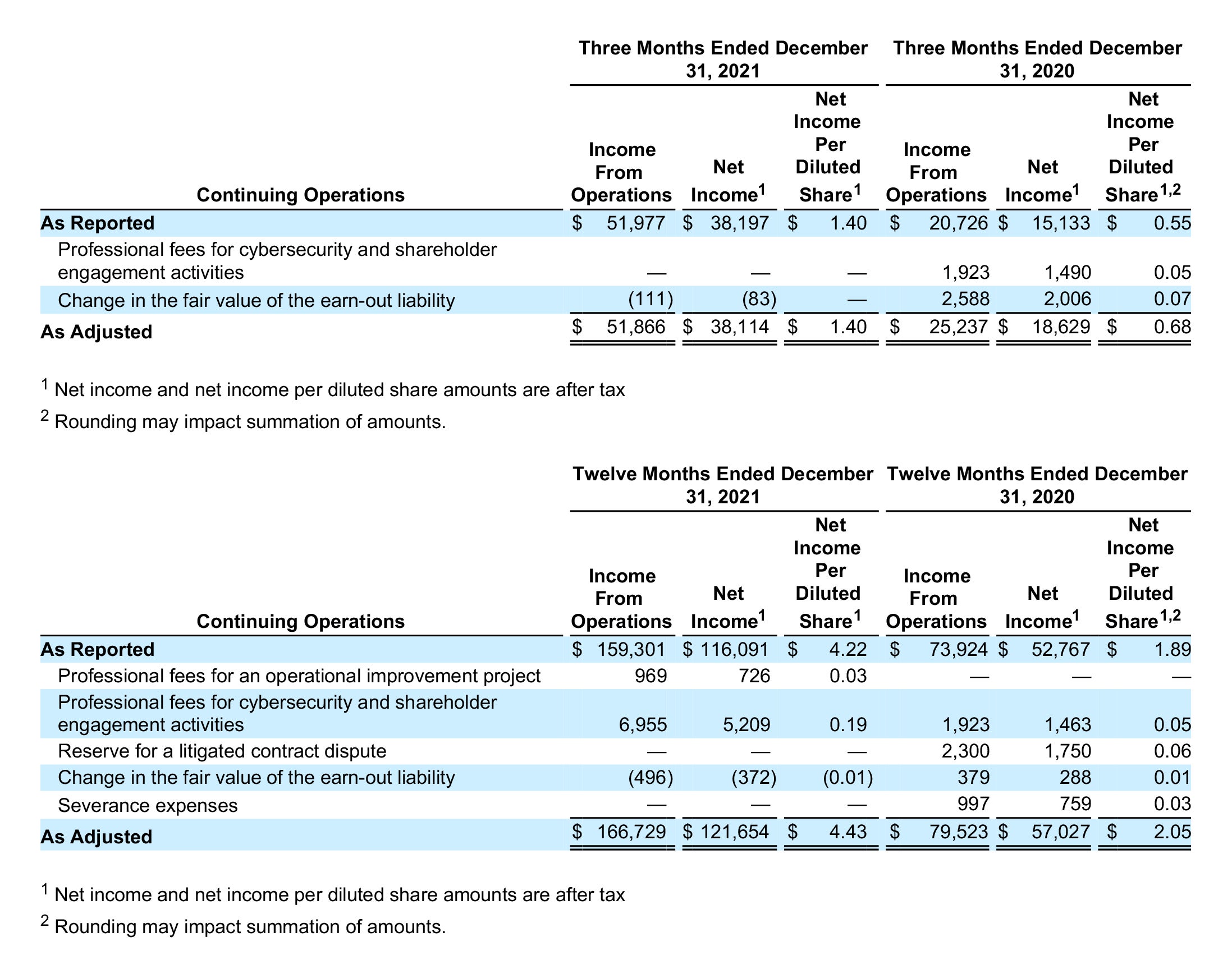

Forward Air Corporation Reconciliation of Non-GAAP Financial Measures

In this press release, the Company uses non-GAAP financial measures that are derived on the basis of methodologies other than in accordance with GAAP. The Company believes that meaningful analysis of its financial performance requires an understanding of the factors underlying that performance, including an understanding of items that are non-operational. Management uses these non-GAAP financial measures in making financial, operating, compensation and planning decisions as well as evaluating the Company’s performance.

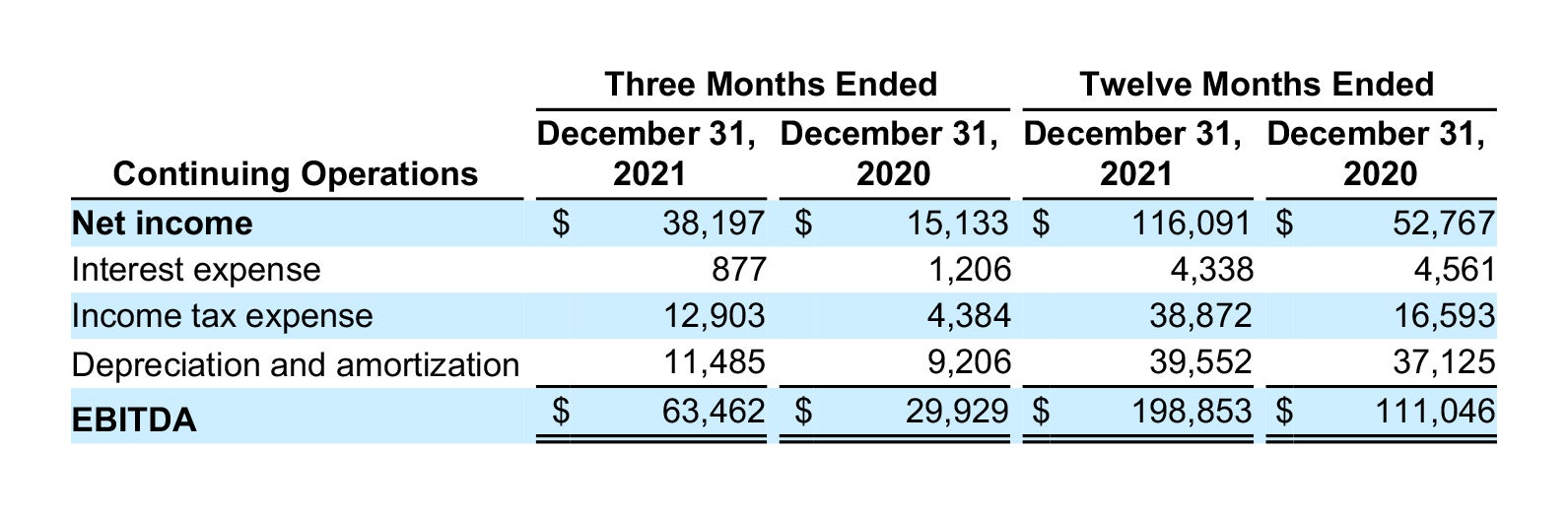

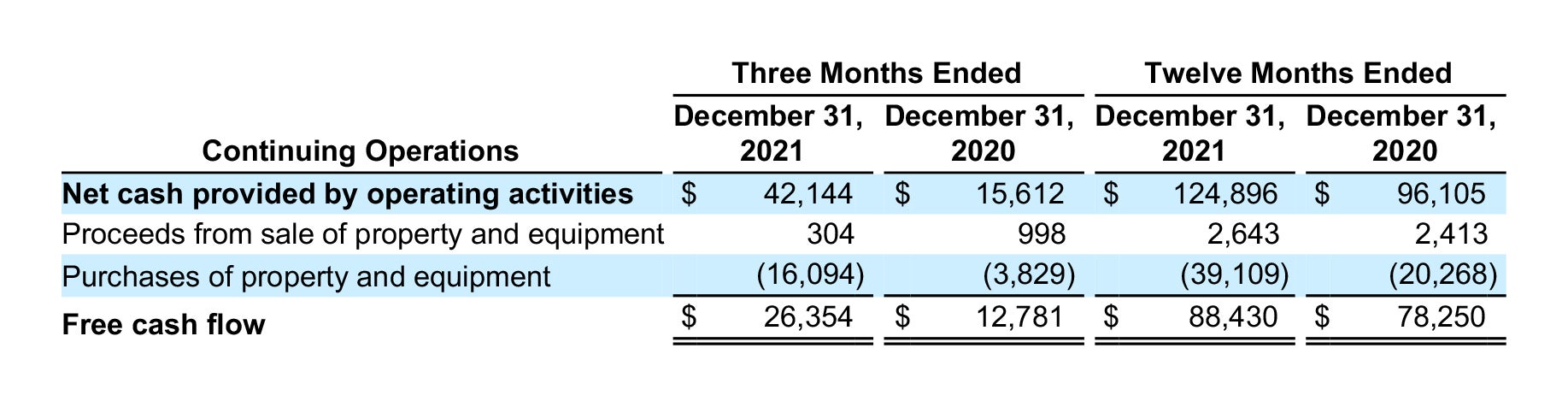

For the three and twelve months ended December 31, 2021 and 2020, this press release contains the following non-GAAP financial measures: earnings before interest, taxes, depreciation and amortization (“EBITDA”), free cash flow, and reported income from continuing operations, net income, and net income per diluted share to adjusted income from continuing operations, net income, and net income per diluted share. All non-GAAP financial measures are presented on a continuing operations basis.

The Company believes that EBITDA from continuing operations improves comparability from period to period by removing the impact of its capital structure (interest and financing expenses), asset base (depreciation and amortization) and tax impacts. The Company believes that free cash flow from continuing operations is an important measure of its ability to repay maturing debt or fund other uses of capital that it believes will enhance shareholder value. The Company believes providing adjusted income from operations, net income and net income per share allows investors to compare Company performance consistently over various periods without regard to the impact of these unusual, nonrecurring or nonoperational items.

Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s financial results prepared in accordance with GAAP. Non-GAAP financial information does not represent a comprehensive basis of accounting. As required by the Securities and Exchange Act of 1933 and the rules and regulations promulgated thereunder, the Company has included, for the periods indicated, a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

The following is a reconciliation of net income from continuing operations to EBITDA from continuing operations for the three and twelve months ended December 31, 2021 and 2020 (in thousands):

The following is a reconciliation of net cash provided by operating activities of continuing operations to free cash flow from continuing operations for the three and twelve months ended December 31, 2021 and 2020 (in thousands):

The following is a reconciliation of reported income from continuing operations, net income, and net income per diluted share from continuing operations to adjusted income from continuing operations, net income, and net income per diluted share from continuing operations for the three and twelve months ended December 31, 2021 and 2020 (in thousands, except net income per diluted share):

The following is a reconciliation of reported net income per diluted share from continuing operations to adjusted net income per diluted share from continuing operations for the three months ended March 31, 2021:

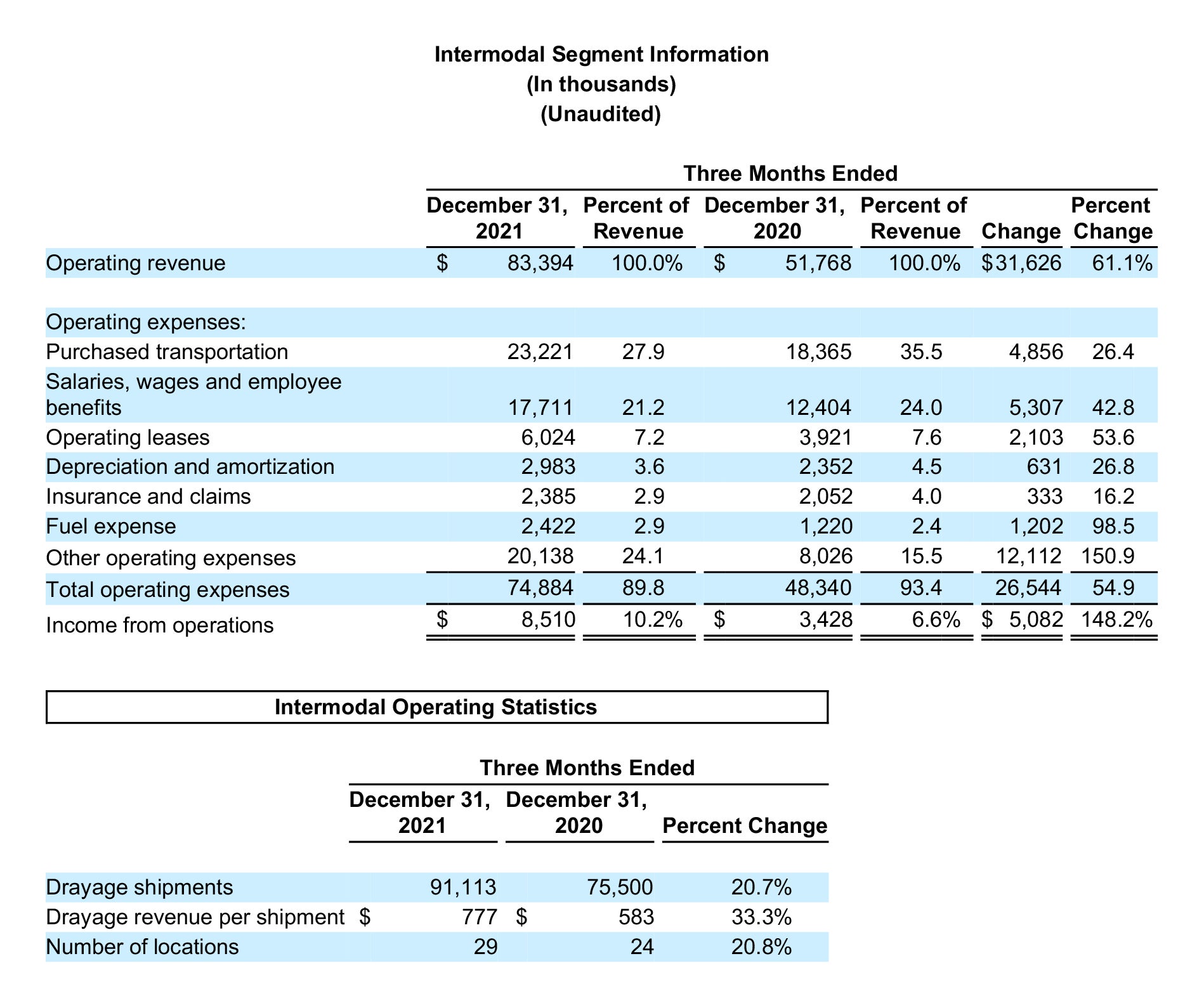

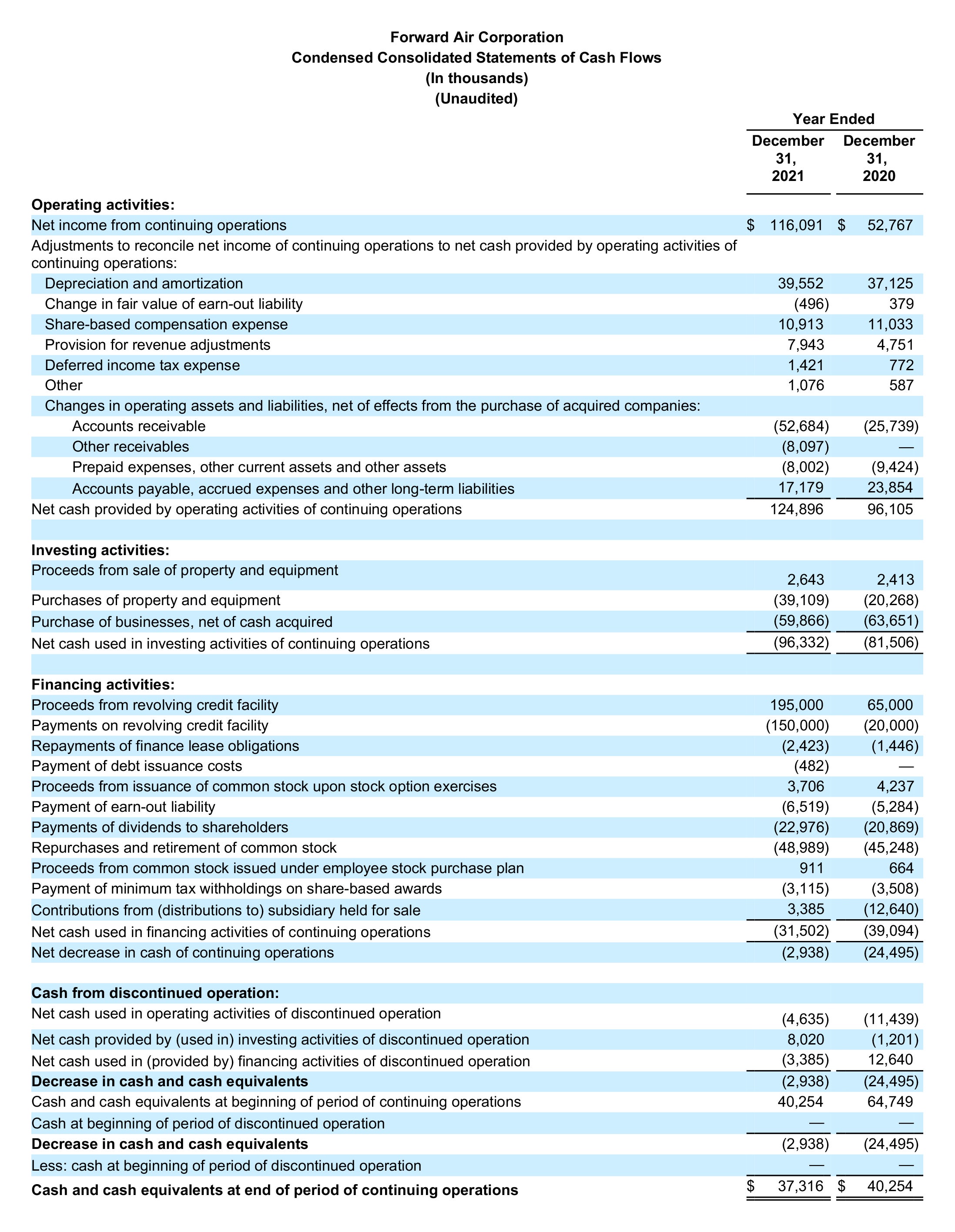

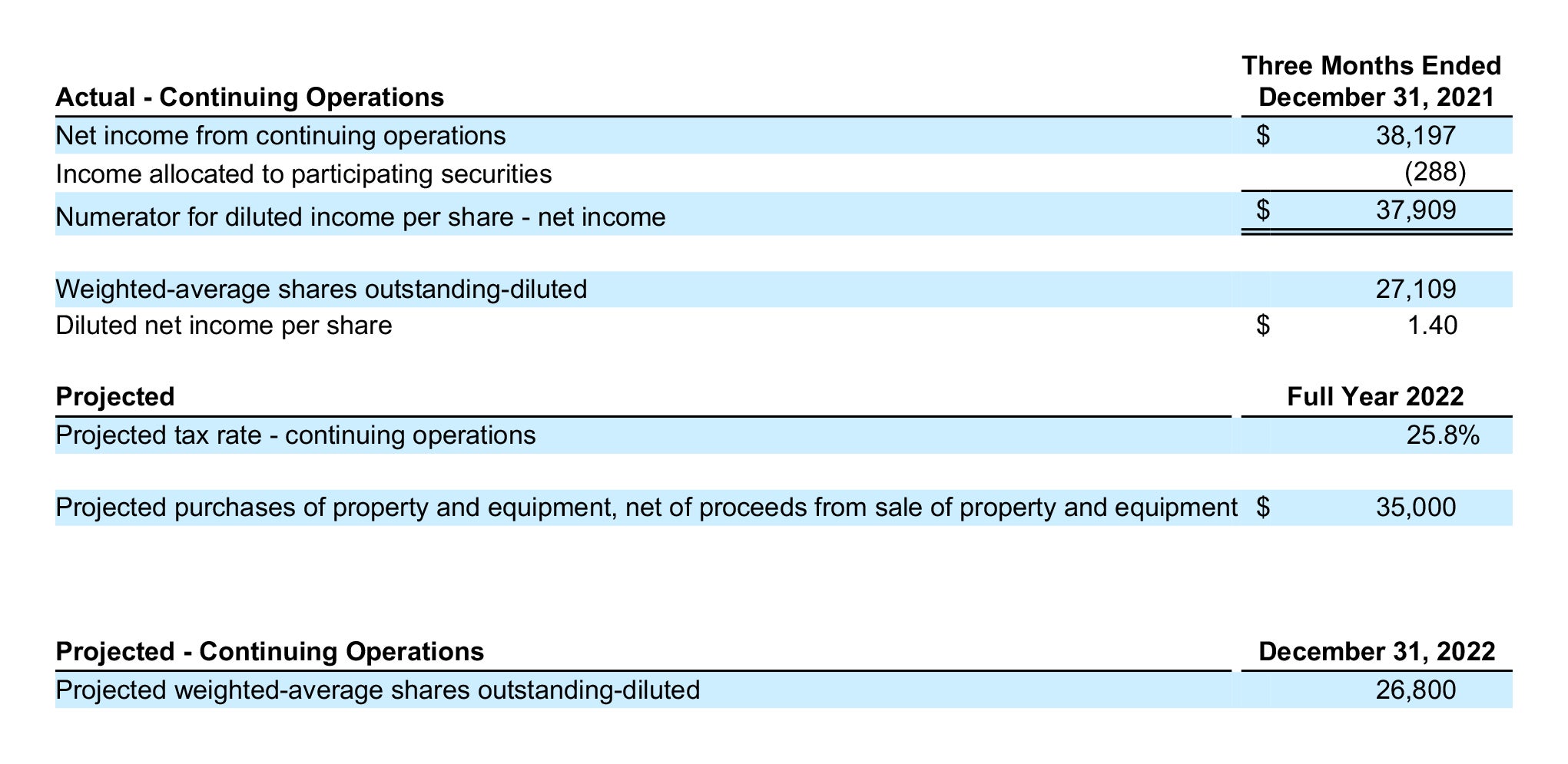

The following information is provided to supplement this press release.

Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward- looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward-looking statements included in this press release relate to the expected organic growth and future performance of the Company, expected first quarter 2022 revenue growth, first quarter 2022 net income per diluted share, pace towards 2023 targets, full year 2022 projected tax rate, fully diluted share count (before consideration of future share repurchase), projected capital expenditures, the future declaration of dividends and, the quarterly and full year 2022 anticipated dividends per share.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward- looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward- looking statements. The following is a list of factors, among others, that could cause actual results to differ materially from those contemplated by the forward-looking statements: economic factors such as recessions, inflation, higher interest rates and downturns in customer business cycles, the COVID-19 pandemic, our ability to manage our growth and ability to grow, in part, through acquisitions, while being able to successfully integrate such acquisitions, our ability to secure terminal facilities in desirable locations at reasonable rates, more limited liquidity than expected which limits our ability to make key investments, the creditworthiness of our customers and their ability to pay for services rendered, our inability to maintain our historical growth rate because of a decreased volume of freight or decreased average revenue per pound of freight moving through our network, the availability and compensation of qualified Leased Capacity Providers and freight handlers as well as contracted, third-party carriers needed to serve our customers’ transportation needs, our inability to manage our information systems and inability of our information systems to handle an increased volume of freight moving through our network, the occurrence of cybersecurity risks and events, market acceptance of our service offerings, claims for property damage, personal injuries or workers’ compensation, enforcement of and changes in governmental regulations, environmental, tax, insurance and accounting matters, the handling of hazardous materials, changes in fuel prices, loss of a major customer, increasing competition and pricing pressure, our dependence on our senior management team and the potential effects of changes in employee status, seasonal trends, the occurrence of certain weather events, restrictions in our charter and bylaws and the risks described in our Annual Report on Form 10-K for the year ended December 31, 2020.

Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

View source version on businesswire.com.